As an e-commerce entrepreneur using Shopify, understanding your tax responsibilities is essential to stay compliant and avoid any problems with the IRS. A key document you’ll need to know about is the 1099-K form. This form plays a significant role in your tax filing process and can help you track your business transactions.

In this article, we’ll explain everything you need to know about Shopify tax documents, with a special focus on the 1099-K form.

Let’s dive in

Key Takeaways

Before checking the details, here are the key points to keep in mind:

- Shopify reports certain business transactions to the IRS using Form 1099-K.

- Not all Shopify sellers will receive a 1099-K form.

- You’re still responsible for reporting your income even if you don’t receive a 1099-K.

- The thresholds for receiving a 1099-K have changed recently, so stay informed about current requirements.

- Proper record-keeping throughout the year is essential for accurate tax reporting.

Understanding The Shopify 1099-K Tax Document

The 1099-K form is a crucial tax document for many Shopify sellers. Here’s what you need to know about this form:

What Is A 1099-K?

A 1099-K is an information return to report payment card and third-party network transactions. This form reports the gross amount of payments processed through Shopify Payments for Shopify sellers. Check the attached link to see how the 1099-K form looks.

Key Information On The 1099-K:

The 1099-K form includes several important pieces of information:

- Gross amount of reportable transactions: This is the total dollar amount of payments processed before any fees, chargebacks, or refunds.

- Number of transactions: The total count of payment transactions processed.

- Merchant category code: A four-digit number that classifies the type of business you operate.

- Name and address: Your business name and address as registered with Shopify.

- Taxpayer Identification Number (TIN): Your EIN or SSN, depending on your business structure.

Check out this link to learn more about how to interpret the 1099-K form and what are the common misunderstandings related to it.

Shopify Tax Documents Required To File For 1099 Taxes

While the 1099-K is a crucial document, it’s not the only one you’ll need when filing your taxes as a Shopify seller. Here’s a comprehensive list of documents you should gather in 2025:

- 1099-K Form: If you meet the eligibility criteria, this form reports your gross transactions processed through Shopify Payments.

- Profit and Loss Statement: This document summarizes your revenue, costs, and expenses for the tax year. You can generate this from your Shopify admin or accounting software.

- Balance Sheet: This provides a snapshot of your business’s financial position, including assets, liabilities, and equity.

- Bank Statements: These help verify your income and expenses, especially for transactions not processed through Shopify Payments.

- Expense Receipts: Keep all receipts for business expenses, including Shopify subscription fees, shipping costs, and marketing expenses.

- Inventory Records: Documentation of your beginning and ending inventory for the year, as well as any inventory purchases.

- Sales Tax Records: If you collect sales tax, keep records of amounts collected and remitted to tax authorities.

- Payroll Records: If you have employees, include documentation of wages paid and payroll taxes withheld.

- Vehicle Mileage Log: If you use a vehicle for business purposes, keep a detailed mileage log.

- Home Office Expenses: If you operate your Shopify business from home, document expenses related to your home office.

- Asset Purchase Receipts: Keep receipts for any major assets purchased for your business, such as computers or equipment.

- Loan Documents: If you have any business loans, include documentation of interest paid.

- Shopify Annual Report: Generate a comprehensive annual report from your Shopify admin, which can serve as a backup for your financial records.

- Marketplace Facilitator Tax Forms: If you sell on other platforms that act as marketplace facilitators, you may receive additional tax forms from them.

Having these documents organized and readily available will make the tax filing process much smoother and help ensure accuracy in your reporting.

Why Is Shopify 1099-K Important?

The 1099-K form serves several crucial purposes for both you and the IRS:

- Income Reporting: It summarizes your gross transactions processed through Shopify Payments, helping you accurately report your income.

- IRS Verification: The IRS uses this form to cross-check the income you report on your tax return, ensuring accuracy and compliance.

- Business Performance: While primarily for tax purposes, the 1099-K can also give you insights into your annual sales performance.

- Audit Protection: Having an official record of your income can be beneficial if you ever face an IRS audit.

- Financial Planning: The form can help you budget and plan for future tax obligations.

Understanding the importance of the 1099-K form underscores why it’s crucial to know if you’re eligible to receive one from Shopify.

Shopify 1099-K Eligibility

To determine if you’ll receive a 1099-K from Shopify, you need to meet certain criteria. For the 2024 tax year (filed in 2025), you’ll receive a 1099-K if:

- You processed more than $20,000 in gross payment volume through Shopify Payments, AND

- You had more than 200 transactions on Shopify Payments.

It’s important to note that these thresholds apply to the total amount processed, not your profit. Even if you had significant returns or refunds, you might still meet these criteria based on your gross sales.

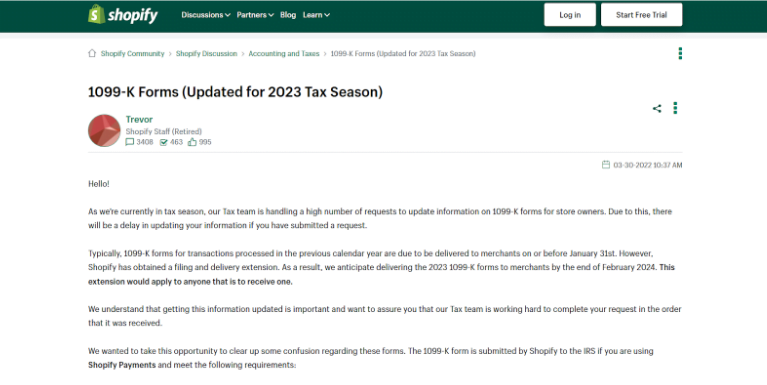

Here’s a snippet of the 1099-K Forms details shared by Shopify here:

Additionally, you may receive a 1099-K if you meet your state’s individual thresholds, which can vary.

Exceptions and Special Cases

While the general rules are straightforward, there are some exceptions and special cases to be aware of:

- Multiple Stores:

If you operate multiple Shopify stores, each store is considered separately. You’ll receive a 1099-K for each store that meets the criteria.

- State-Specific Requirements:

Some states have lower thresholds for issuing 1099-K forms. For example, in Massachusetts, you’ll receive a 1099-K if you processed more than $600 in payments, regardless of the number of transactions.

- Partial Year Operations:

If you started your Shopify store mid-year, the thresholds still apply to your total annual transactions and volume.

- Non-US Sellers:

The 1099-K reporting requirement generally applies only to US-based sellers. However, international sellers with US customers should consult with a tax professional about their specific obligations.

- Payment Processor Changes:

If you switched payment processors during the year, you might receive multiple 1099-K forms, each covering the period you used that specific processor.

Understanding these nuances can help you anticipate whether you’ll receive a 1099-K and plan accordingly.

How To Get The 1099-K Form From Shopify

If you meet the eligibility criteria, Shopify will provide your 1099-K form in one of two ways:

- Email Notification: Shopify will send an email notification when your 1099-K is ready, typically by January 31st of the year following the tax year.

- Shopify Dashboard: You can access your 1099-K directly from your Shopify admin panel.

Here’s how:

- Log in to your Shopify account

- Go to Settings —> Payment providers

- Click on Shopify Payments

- Select View payouts

- Navigate to the Documents tab

- Download your 1099-K form

If you’re eligible but don’t see your form by early February, contact Shopify support for assistance.

What If You Don’t Get 1099-K From Shopify

If you don’t meet the thresholds for receiving a 1099-K, or if there’s an issue with your form, here’s what you should do:

- Check Your Eligibility: Review your annual sales and transaction numbers to confirm whether you should have received a form.

- Contact Shopify Support: If you believe you should have received a 1099-K but didn’t, reach out to Shopify’s support team for clarification.

- Use Your Own Records: Even without a 1099-K, you’re still required to report your income. Use your Shopify reports and bank statements to calculate your gross income.

- Generate a Sales Report: You can create a sales report in your Shopify admin to get an overview of your annual transactions:

- Go to Analytics > Reports

- Select Sales by product

- Set the date range for the entire tax year

- Export the report

- Document Your Process: Keep detailed notes on how you calculated your income in case of future questions from the IRS.

- Consider Professional Help: If you’re unsure about how to proceed without a 1099-K, consider hiring a tax professional for guidance.

Remember, not receiving a 1099-K doesn’t exempt you from reporting your Shopify income. It’s your responsibility to accurately report all business income, regardless of whether you receive formal documentation.

How To File Taxes With Shopify 1099-K Form

Once you have your 1099-K, here’s how to use it when filing your taxes:

- Verify the Information: Check that the details on the form match your records. Pay particular attention to the gross amount of reportable transactions.

- Report on Schedule C: Use the information from your 1099-K to help complete Schedule C (Form 1040), which reports profit or loss from your business.

- Reconcile with Your Records: The 1099-K reports gross transactions, so you’ll need to account for returns, refunds, and fees when calculating your actual taxable income.

- Consider Other Income Sources: Remember, the 1099-K only covers transactions processed through Shopify Payments. Include income from other sources as well.

- Calculate Deductions: Don’t forget to account for your business expenses, which can reduce your taxable income.

- Consult a Professional: If you’re unsure about any aspect of your tax filing, it’s wise to consult with a tax professional familiar with e-commerce businesses.

Remember, the 1099-K is just one piece of your tax puzzle. You’re responsible for reporting all of your income, regardless of whether you receive a 1099-K or not.

Related Reads:

Conclusion: Shopify Sends 1099-K For Tax Reporting!

Keeping track of taxes as a Shopify seller can seem daunting, but understanding the importance of the 1099-K form and other necessary tax documents is crucial for maintaining compliance and accurately reporting income.

Remember, even if you don’t receive a 1099-K, you’re still responsible for reporting all of your business income.

Stay organized throughout the year, keep detailed records, and don’t hesitate to seek professional help if you’re unsure about any aspect of your tax obligations.

By staying informed and prepared, you can focus more on growing your Shopify business and less on worrying about tax season.

FAQs

You don’t need to wait. You can file your taxes using your own accurate records of income and expenses.

First, verify your own records. If there’s still a discrepancy, contact Shopify support for clarification. Remember, the 1099-K reports gross transactions, which may differ from your net income.

Generally, yes, but some states may have different reporting requirements. Check with your state’s tax authority or a tax professional for guidance.

The IRS recommends keeping tax records for at least three years from the date you filed your return or two years from the date you paid the tax, whichever is later.

You’ll receive a separate 1099-K for each store that meets the reporting thresholds. You’ll need to report income from all your stores on your tax return.